Navigating global

self-injection market trends and regional strategies

Understanding regional market dynamics is essential for successful combination product launch.

Understanding regional market dynamics is essential for successful combination product launch.

In today’s rapidly evolving self-injection landscape, understanding both global trends and local market conditions is essential for the successful launch of combination products. Since regulatory frameworks, therapeutic requirements, and pricing dynamics differ across regions, developing tailored strategies for each market is essential to achieving commercial success.

With design offices and operations across North America, Europe, and Asia, SHL Medical offers a global perspective rooted in hands-on experience. Our multinational presence ensures not only manufacturing and logistical reach, but also provides strategic insight into the nuances that define each regional market.

To illustrate how companies can align their combination product strategies with regional demands, SHL Medical’s regional business development leaders share frontline insights drawn from working closely with pharmaceutical partners across the globe.

North America: Leading innovations in self-injection and cardiometabolic care

In 2024, North America accounted for approximately 42% of the global self-injection device market.1 According to SHL Medical’s Head of Business Development Americas, Paul Martinez, this significant market share stems from a concentration of major pharmaceutical companies that continue to pioneer novel therapies, supporting the need for advanced self-injection solutions within the region and beyond.

Head of Business Development Americas, Paul Martinez |

“North America’s leading position in self-injection treatments is partly due to the region’s vast and varied geography, which can make frequent visits to healthcare facilities challenging, leading to the need for at-home self-injection options,” says Paul. Over the past decade, this practical necessity has been reinforced by a steady incline in chronic diseases such as diabetes, rheumatoid arthritis, and cardiovascular diseases. The percentage of adults with one or more chronic conditions rose from 72.3% in 2013 to 76.4% in 2023 in the US,2 and from 41.2% in 2015 to 46.1% in 2023 in Canada.3 This rising prevalence drives the growing demand for at-home administration of injectable therapies. Among the chronic conditions prevalent in the region, obesity has emerged as one of the most pressing concerns, with adult prevalence in the US estimated as 40.3% in a recent NHANES survey (August 2021-August 2023).4 |

This substantial prevalence has driven demands for glucagon-like peptide-1 receptor agonists (GLP-1 RAs), a leading therapeutic class for weight and glycemic management. Valued at US$26.6 billion in 2023, the US GLP-1 RA market is projected to reach US$133.2 billion by 2030, with a CAGR of 25.9%.5

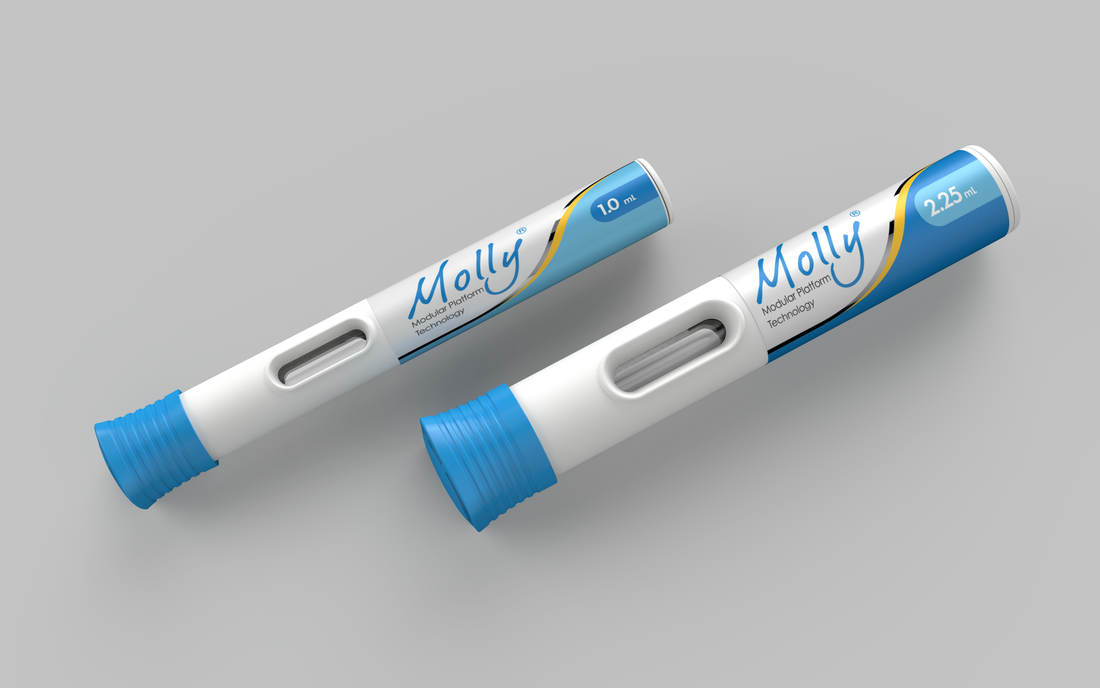

Since 2015, SHL Medical has supported the launch of six combination products indicated for cardiometabolic diseases, with nearly 50 million devices delivered in 2023. Key to this success is our Molly® modular platform. To date, the platform has supported 21 distinct combination product approvals across 28 indications, reflecting its continued use in chronic disease management.

As market adoption of GLP-1 RA therapies continues to grow, ensuring device supply at scale has become just as critical. In early 2025, SHL Medical held the grand opening of a 360,000-square-foot facility in North Charleston, South Carolina. This site complements SHL Medical’s operations in Deerfield Beach, Florida, which provides final assembly, labeling, and packaging services. Together, these facilities expand production capacity, support localized production, and strengthen supply chain efficiency across North America and beyond.

Opened in 2025, our North Charleston site is equipped with advanced injection molding and fully automated assembly capabilities.

Europe: Cost-conscious and sustainability-driven self-injection market

The European pharmaceutical market is fragmented by different languages, regulatory frameworks, and pricing mechanisms across countries. Yet, according to SHL Medical’s Head of Business Development Europe, the Middle East, and Africa, Michael McGowan, the region is unified by strong social healthcare models, where cost containment and cost-effectiveness remain key priorities of governments.

|

European countries implement various pricing regulations, including reference pricing and mandated price reductions, to maintain sustainable healthcare systems. This emphasis on affordability has accelerated adoption of generics and biosimilars, which are typically 20–80% less expensive than originator drugs.6 “Compared to the US, where a few large pharma players dominate a relatively unified market, Europe is not only more complex but also more competitive, with multiple players each holding smaller market shares due to the push for biosimilars,” says Michael. |

Head of Business Development EMEA, Michael McGowan |

SHL Medical’s Molly modular platform autoinjectors reduce risk, cost, and time-to-market via pre-validated designs and configurable options built on a proven technology.

Sustainability is another crucial consideration in the European market. Since 2019, the European Green Deal and the “Fit for 55” package were launched with the goal to make the EU climate-neutral by 2050, compelling industries to adopt greener operations.7 Regulatory initiatives such as the Corporate Sustainability Reporting Directive (CSRD) now require companies to disclose their environmental impact, including greenhouse gas (GHG) emissions, across supply chains.8 As such, a robust Environmental, Social, and Governance (ESG) strategy has become essential for pharmaceutical companies.

SHL Medical is expanding its sustainability initiatives across global operations. A new manufacturing site in Zug, Switzerland is a clear example of these efforts. The facility incorporates features such as lake water cooling and waste heat recovery systems connected to the local district heating network. This site increases regional production capacity and aligns with sustainability standards in Europe’s healthcare sector.

APAC: Innovation and cost-effectiveness in a rapidly evolving self-injection market

Head of Business Development APAC, Markus Bauss |

The Asia-Pacific (APAC) region is emerging as a key yet highly diverse arena for self-injection devices. According to Markus Bauss, SHL Medical’s Head of Business Development APAC, the APAC region can be broadly categorized into two primary market types: those driven by competition for advanced technology and those focused on cost competitiveness. Despite these differences, “a shared priority across APAC is the need for accelerated product launches and flexible adaptation to local market needs,” says Markus. Markets such as Japan and South Korea represent the innovation-driven markets, characterized by early adoption of novel technologies, with a strong focus on digital integration and next-generation delivery solutions. |

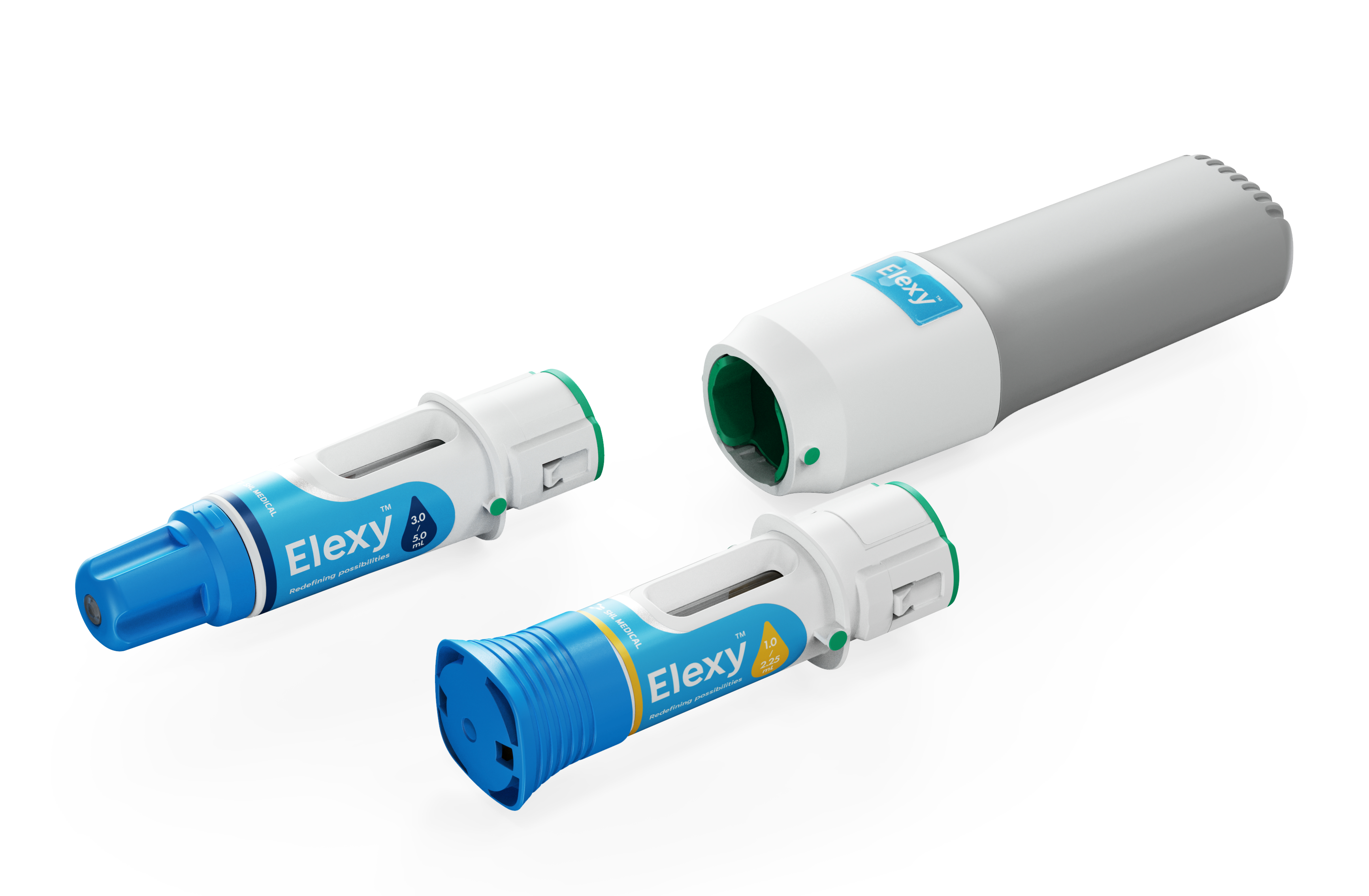

Equipped with a battery-powered motor and cellular connectivity, SHL Medical's electromechanical Elexy™ autoinjector represents a new generation of self-injection devices, reflecting our continued exploration of novel technologies.

Meanwhile, high-potential markets such as China and India are driven by large populations and rising healthcare needs. China’s self-injection device market, for example, is forecasted to reach US$1.92 billion by 2030, growing at a CAGR of 10.8% from 2025.9 In these markets, cost-effectiveness and scalability are key success factors. Strategies may include adopting alternative, lower-cost materials, utilizing optimized device formats such as multi-dose delivery systems, and forming local manufacturing partnerships to improve cost-effectiveness.

To address these varying demands, SHL Medical continues to expand its operational footprint in the region with a manufacturing site in Taoyuan-Liufu and a new 47,000 sqm facility in Taoyuan-Nanmei, expected to open in 2027. A new office in Shanghai, opened in 2025, further supports regional engagement. The expanded infrastructure contributes to increased production capacity and localized support for APAC-based combination product projects. We are also exploring opportunities to further expand our manufacturing presence in APAC to bring us closer to high-potential markets like China and India, while fostering collaboration with local partners to further strengthen our regional capabilities.

In the evolving global self-injection market, collaborating with a manufacturing partner with proven expertise is essential to achieve commercial success. With over 35 years leading the drug delivery industry and a track record of supporting combination product launches in more than 75 markets, SHL Medical is positioned to offer the strategic insight and operational expertise needed to navigate diverse regional markets. To learn more about how we can support your next project, check out our device solutions and end-to-end services.

References

1. Self-injection devices market size and share report, 2030. (2024). Grandviewresearch.com. https://www.grandviewresearch.com/industry-analysis/self-injection-devices-market-report

2. CDC. (2025). Trends in multiple chronic conditions among U.S. adults, by life stage, behavioral risk factor surveillance system, 2013–2023. CDC.gov. https://www.cdc.gov/pcd/issues/2025/24_0539.htm

3. Statistics Canada. (2024). Health of Canadians: Health outcomes. Government of Canada. https://www150.statcan.gc.ca/n1/pub/82-570-x/2024001/section2-eng.htm

4. CDC. (2024). Obesity and severe obesity prevalence in adults: United States, August 2021–August 2023. CDC.gov. https://www.cdc.gov/nchs/products/databriefs/db508.htm

5. The United States GLP-1 receptor agonist market size and outlook, 2030. (2025). Grandviewresearch.com. https://www.grandviewresearch.com/horizon/outlook/glp-1-receptor-agonist-market/united-states

6. Are generic medicines in Europe too expensive? (2024). Gabionline.net. https://gabionline.net/generics/research/Are-generic-medicines-in-Europe-too-expensive

7. European Council. (2022). Fit for 55 - the EU’s plan for a green transition. Consilium. https://www.consilium.europa.eu/en/policies/fit-for-55/

8. European Commission. (2024). Corporate sustainability reporting. https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

9. China self-injection devices market size and outlook, 2030. (2025). Grandviewresearch.com. https://www.grandviewresearch.com/horizon/outlook/self-injection-devices-market/china